I stand out on the Aptus team for having not played major college basketball, but as an avid fan I can at least contribute to the banter. Complementing the content put out by my playing partners at The Backcourt Report, I periodically share my “Starting Five” posts highlighting the best I can find in the areas of investment management, behavioral finance, and the advisory business. Enjoy, subscribe, share!

The Inflation Advantage of Equal-Weight: great summary from Lawrence Hamtil, reiterating his prior thoughts on the dual performance benefits of more exposure to big winners(reward) and less exposure to extreme sector & megacap concentration. A new advantage is discussed here, that larger and broader exposure to sectors that benefit from the inflation that’s been hiding for the last 30 years but whose reappearance is starting to look more likely.

How Outsourced Investing Strategies Are Reshaping Wealth Management: technology continues to be the great enabler of better investment delivery to advisory clients. Streamlined access to a broad selection of asset management approaches is empowering advisors to spend more time with clients while also making their practices easier to run(and thus more valuable).

Moneyball 2.0: such a fun story, how the Houston Astros went from baseball laughingstock to World Series Champions. The parallels with investing are obvious as you listen, which Ted does a great job of extracting. The clear lesson is in taking the best of human and data-based approaches to create a culture of collaborative, evidence-backed decision-making.

Leveraged-Loan Lovefest Will End in Heartbreak: everyone knows rates are heading higher(are they?), and floating-rate funds remain the darling of fixed-income allocators. After whiffing on underlying risks in the global financial crisis, ratings agencies such as Moody’s are sounding the alarm on the hidden dangers of the underlying credit.

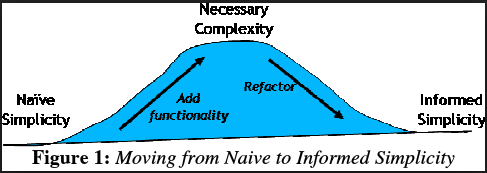

The Perfect Portfolio: as Aptus founder states, the perfect portfolio is the one that is understood and can be confidently held. The behavior gap is pervasive, and can ruin the best portfolio construction without clarity of process and respect for the investor’s risk tolerance.

Hope you enjoy this edition of our Starting Five, join the updates here!